Come è strutturato il conto economico dell’e-commerce e perché è importante farlo nel modo giusto? Per i gestori di ecommerce moda e i direttori digital è fondamentale conoscere nel dettaglio ogni singola riga del conto economico.

Il conto economico o P&L dell’e-commerce offre ai manager un quadro dello stato di salute dell’e-commerce, risponde ad alcune domande essenziali, ad esempio:

- Abbiamo realizzato un profitto l’anno scorso? Stiamo progettando di realizzare un profitto?

- I ricavi sono in aumento o in diminuzione rispetto allo scorso anno (LY)?

- A quanto ammonta il nostro margine di profitto lordo?

- Quanto spendiamo in logistica, spedizioni, customer care?

- Quanto stiamo spendendo nel Marketing?

Come puoi vedere, il P&L dell’e-commerce fornisce risposte ad alcune domande molto importanti. Il P&L ecommerce risponde anche a domande riguardanti l’andamento del tuo ecommerce, ad esempio:

- Quest’anno il nostro margine lordo è diminuito del 5% rispetto a LY

- L’anno scorso il nostro sconto medio è aumentato dal 10% al 12% rispetto all’anno precedente (PY)

- Si prevede che l’anno prossimo il costo delle spedizioni aumenterà dal 5% al 6% sui ricavi netti

Indice dei contenuti

Differenze di impostazione del P&L ecommerce da azienda ad azienda

È importante capire che non esiste un unico modo per scrivere un conto economico e-commerce, poiché dipende dagli standard finanziari che seguiamo. Anche a livello contabile sono diversi i principi che le aziende possono utilizzare e, a seconda dello standard utilizzato, la formattazione del conto economico dell’e-channel commerce o altro canale può essere diversa.

L’importante è mantenere coerenza nel modo in cui calcoliamo le voci di ricavo e di costo nel conto economico dell’ecommerce da un anno all’altro, questo permette di evidenziare andamenti degli indicatori di performance nel tempo che siano coerenti tra loro. Ad esempio, se calcoliamo il costo dei beni venduti in un modo in un anno, dobbiamo calcolarlo nello stesso modo l’anno successivo per poterlo confrontare. Ecco alcuni altri esempi:

- Quest’anno il nostro margine lordo è diminuito del 5%

- Quest’anno il nostro sconto medio è aumentato dal 10% al 12%

- Quest’anno il costo della spedizione è aumentato dal 5% al 6% sul fatturato netto

Rif. https://www.accountingtools.com/articles/2017/5/5/purchase-price-variance

Termini P&L dell’e-commerce, KPI e acronimi

- Vendite lorde o vendite lorde (Top Line): si tratta delle vendite prima dei resi e prima delle tasse Imposta sul valore aggiunto (IVA) o (imposta sulle vendite) o dazi.

- Vendite nette: vendite lorde meno resi e-commerce

- Utile prima di interessi e tasse EBIT (bottom line)

- COGS: costo delle merci vendute

- Costo standard (Standard Cost): è un modo di calcolare il costo del venduto in base al costo delle componenti del prodotto: costo del materiale utilizzato + costo della lavorazione = costo del prodotto.

- Deprezzamento o svalutazione dei prodotti di magazzino: ogni prodotto tende a perdere valore se non viene venduto e rimane a lungo in magazzino. Per questo motivo vengono definite convenzioni e pratiche per la svalutazione dei prodotti in magazzino. Tali valori vengono iscritti come costi nel conto economico del canale ecommerce.

- Monitoraggio delle vendite e-commerce: vendite lorde e vendite nette

- Molto spesso le vendite negli e-commerce vengono chiamate con il termine inglese Sales o Revenue a cui vengono aggiunti i prefissi Gross e Net.

Il tracciamento delle vendite e-commerce: gross sales vs. net sales

Molto spesso le vendite nell’e-commerce vengono chiamate con il termine inglese Sales o Revenue a cui si aggiungono i prefissi Gross e Net.

Premesso che l’utilizzo dell’Inglese non chiarisce né semplifica la comprensione di questi termini, spieghiamo di seguito in maniera chiara cosa significano questi termini.

Indipendentemente dello standard di contabilità che adottiamo i termini vendite nette e lorde devono essere molto ben chiari all’interno dell’azienda e devono riflettere le necessità di tracciamento dei risultati del canale e-commerce rispetto agli obiettivi.

| Vendite | Spiegazione |

| Vendite lorde | Vendite Lorde iva Inclusa o scontrinato. Corrisponde alla somma totale pagata dai clienti per i prodotti acquistati. A volte questo concetto viene associato al concetto di “Demand” ovvero gli ordini dei clienti finali inseriti a sistema prima di scontare eventuali resi o problemi di consegna. |

| Vendite lorde prima degli sconti | Si riferisce al prezzo teorico o prezzo di listino che gli utenti avrebbero pagato se avessero acquistato senza sconti. Questa metrica serve per calcolare lo sconto medio applicato dal canale e-commerce o retail rispetto al prezzo di listino e quindi comparare anche le performance tra canali ad esempio quale canale tra e-commerce e retail effettua più sconti? |

| Vendite Net Net | Le vendite Net Net rappresentano le vendite netto resi e netto IVA quindi Vendite Lorde – IVA – Resi = Vendite Net Net |

| Fatturato | Il fatturato è una dato contabile che significa le vendite nello IVA e Netto Credi Notes emesse + Eventuali risconti (stima delle credit notes non ancora emesse ma di pertinenza del periodo di riferimento, ad esempio anno o trimestre) |

Il calcolo delle vendite e-commerce con il metodo standard cost + mark-up

Se calcoliamo le vendite lorde con il metodo dello standard cost + mark up per esempio possiamo stimare con accuratezza le vendite al lordo degli sconti. Mentre se calcoliamo le vendite sulla base dell’incasso perdiamo l’informazione sullo sconto effettuato.

Il conto economico del canale e-commerce si presenta generalmente così:

| Vendite lorde = costo standard o costo industriale * mark-up | |

| Costo industriale | 50 |

| Mark-up | 3 |

| Prezzo vendita | 150 |

| Totale unità vendute nel periodo (es. un mese) | 1.000 |

| Fatturato lordo | 150.000 |

| – Sconti | 15.000 |

| Vendite lorde netto sconto | 135.000 |

| – Resi | 35.000 |

| = Vendite nette | 100.000 |

La redicontazione dei resi nel P&L ecommerce

I resi nell’e-commerce possono essere rendicontati in due modi: attraverso la data di ricezione del reso in magazzino o attraverso la data di emissione della fattura o ricevuta di vendita.

Il primo modo non richiede la stima della quantità di resi che verranno ricevuti nel periodo, in quanto i resi vengono registrati nel sistema contabile dopo la ricezione fisica del prodotto. Mentre con il secondo metodo è necessario stimare i resi che verranno ricevuti dopo la scadenza di ogni periodo di rendicontazione fiscale.

Facciamo un esempio per spiegare questo secondo metodo di calcolo dei resi che è quello a mio modo di vedere il più corretto: immaginate di gestire un e-commerce di beni fisici, diciamo prodotti di moda, siete al 1° dicembre e decidete di estendere il periodo di reso di tutti gli ordini ricevuti dal 1° al 31 dicembre a fine gennaio dell’anno successivo. Così facendo state a tutti gli effetti influenzando il risultato operativo dell’e-commerce riducendo artificialmente i resi del periodo in corso spostandoli sul primo trimestre dell’anno successivo.

La mia raccomandazione operativa è quindi quella di calcolare il tasso di reso medio del sito e applicare il tasso di reso medio nel computo dei resi nel momento del chiusura del bilancio del canale e-commerce.

Il conto economico dell’e-commerce, un modello semplificato.

| Vendite | |

| – Vendite lorde | 1.000.000 |

| – Resi | 150.000 |

| = Vendite nette | 850.000 |

| Costi | |

| – Costo del venduto (COGS) | 250.000 |

| Margine Lordo (Gross Margin) | 600.000 |

| Costi diretti | |

| – Risorse umane | 100.000 |

| – Produzione contenuti (fotografia, decrizioni, ecc) | 50.000 |

| – Piattaforma tecnologica | 50.000 |

| – Marketing | 100.000 |

| – Logistica | 100.000 |

| – Pagamenti | 20.000 |

| Margine operativo (EBITDA) | 180.000 |

| – Ammortamenti e Svalorizzazioni | 50.000 |

| Utile prima delle Imposte (EBIT) | 130.000 |

I costi dell’e-commerce

Come gestire ricavi e corsi nel P&L ecommerce per renderlo redditizio

Quando gestisci un sito web di e-commerce o possiedi un’attività che vende online, devi avere molto chiaro come è strutturato il conto economico dell’e-commerce. Controllare ogni singola riga del conto economico dell’e-commerce è essenziale per garantire la redditività del canale e-commerce.

In questo articolo descriviamo i centri di costo essenziali di cui tenere conto e che determinano la redditività del tuo e-commerce digitale. Trovi anche un esempio di p&l e-commerce che illustra tutte le voci di profitto e di costo.

Centri di costo

Digital Production: fotografia e digitalizzazione del prodotto

La filiera digitale è l’attività che consiste nella realizzazione di foto, video, descrizioni, traduzioni dei prodotti.

Logistica

La logistica è in genere il magazzino in cui si immagazzina la merce, può essere gestito direttamente dal marchio o da un servizio noleggiato, in questo caso è un 3PL di logistica di terze parti. Nel costo logistico includiamo anche il trasporto in entrata e in uscita.

Costo della tecnologia

L’ecommerce necessita di diverse applicazioni tecnologiche che devono essere integrate per gestire tutti i flussi di dati: prodotti, stock, prezzi, ordini, dati dei clienti.

Costo del venduto

Il costo delle merci vendute è la prima “voce di costo” che trovi nel conto economico dell’e-commerce, i ricavi netti: il costo delle merci vendute determina il margine lordo che è un KPI essenziale per la redditività dei marchi di moda.

Costi Legali e Amministrativi dell’ecommerce

I costi che non sono generati specificamente dall’e-commerce, come i costi del top management, delle finanze, dell’amministrazione e delle risorse umane, vengono ripartiti proporzionalmente sui centri di profitto. Ad esempio, il costo dell’amministrazione è diviso tra i dipartimenti Retail, Wholesale ed Ecommerce proporzionalmente alle entrate generate da ciascun canale di vendita

Costo del personale

I team di e-commerce sono composti da poche o centinaia di dipendenti a seconda delle dimensioni dell’azienda. In genere hai un responsabile o direttore e-commerce e hai un responsabile del negozio, un acquirente, un visual merchandiser, un grafico, un responsabile delle operazioni per supervisionare la logistica, il servizio clienti e il funzionamento, potresti avere una persona IT all’interno del tuo team di e-commerce e uno o più operatori del Servizio Clienti.

Marketing digitale

Il Digital Marketing è uno degli investimenti essenziali che bisogna fare per vendere online, l’investimento nel Digital Marketing è fondamentale per generare traffico. Mentre nei negozi fisici il traffico è generato dalla posizione, online è necessario investire nel marketing digitale per creare traffico. Puoi investire nel traffico a pagamento, ad esempio nella pubblicità, oppure puoi creare contenuti che attirino organicamente i visitatori, questo è anche chiamato content marketing.

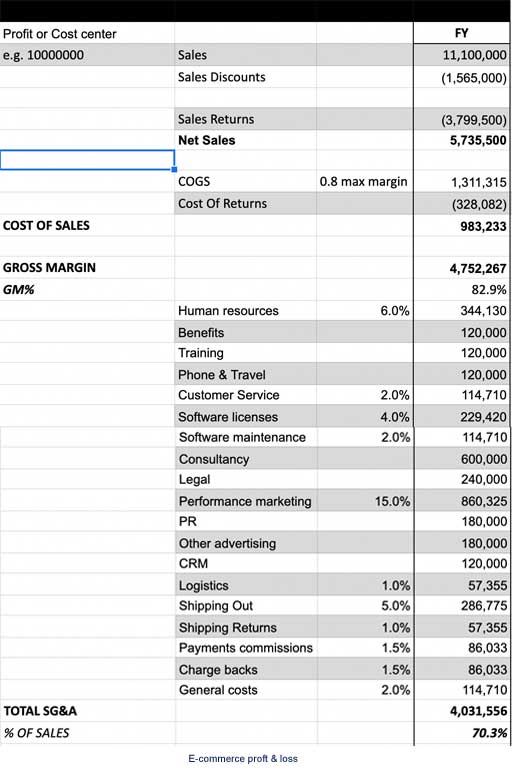

Esempio di P&L ecommerce

Questo è un esempio di un conto profitti e perdite completo per un e-commerce che vende prodotti di moda. Puoi notare la struttura dei centri di profitto e di costo sulla sinistra. Nelle prime 4 righe del conto economico hai le voci del conto economico che determinano i ricavi netti o vendite nette: Gross Sales (Sales) – Sconti (Sales Discounts) – Resi in valore (Sales Returns).

Il calcolo del COGS Costo del Venduto nell’e-commerce

Dal punto di vista della contabilità il costo del venduto è ogni costo direttamente correlato al prodotto venduto ovvero stiamo parlando di un costo che si verifica solo se il prodotto viene venduto.

Per il corretto calcolo del costo del venduto dobbiamo prendere in considerazione tre fattori:

- Il buying e-commerce: quindi le immobilizzazioni di prodotti che acquistiamo e allochiamo sul magazzino e-commerce con l’obiettivo di venderli nel corso di una o più stagioni e il loro grado di svalutazione (depreciation)

- I COGS sono dei costi quando vendiamo i prodotti e sono dei ricavi quando riceviamo dei resi. Questo è un dato di fatto, bisogna solo ricordarsi di calcolarli correttamente.

- Se la disponibilità di merce vendibile sul canale e-commerce non è allocata esclusivamente sul magazzino e-commerce ma è la sommatoria di più magazzini il costo del venduto non può essere calcolato sul valore del buying o ordine e-commerce.

Quali costi inserire nei cogs nel conto economico?

Una regola possibile è quella di seguire quelli che sono i costi direttamente collegati alla vendita del prodotto, quindi le materie prime utilizzate e il costo del lavoro impiegato per la realizzazione del prodotto. Cosa facciamo però con le fee pagate alle carte di credito e le commissioni di vendita? Anche queste sono spese che si verificano solo se un prodotto viene venuto, ma generalmente vengono riportate più in basso nel conto economico dell’e-commerce.

La prassi generale è quella di riportare le spese relative a commissioni vendite più sotto nel conto economico, perché se includessimo tutte le spese di vendita nel costo del venduto (COGS) otterremmo un margine lordo (gross margin) più basso. Se siete un’azienda quotata, avere un margine lordo significativamente più basso rispetto alla concorrenza può creare problemi nella valutazione.

Che cosa va nel costo del venduto di una azienda che produce software as a service?

In questo caso il software fornito al cliente è il servizio che vendiamo, per cui dovremo inserire nei cogs il costo dei server e delle persone che manutengono i server, se pagate delle royalty sulle vendite del software anche queste sono un costo del venduto e se l’azienda aiuta i clienti nell’uso del software anche questo potrebbe essere considerato un costo del venduto.

In conclusione la strada migliore per determinare le componenti del costo del venduto è guardare cosa fanno le aziende leader di settore nel mercato di riferimento e chiedere indicazioni alle società di revisione (auditors) che sapranno dare delle indicazioni sufficientemente chiare e lasciando a voi la scelta di dove posizionare alcuni elementi di costo. Una volta fatta questa scelta è bene mantenerla per diversi periodi contabili per avere la possibilità di fare dei confronti anno su anno e determinare i trend.

Per approfondire: Steve Bragg podcast episodio 323 the cost of goods sold

Che cosa non abbiamo considerato

- Costi fissi e costi variabili –> proiezione

- KPI come il tasso di sconto medio

- IVA e imposte

- Costi indiretti: costi aziendali ad esempio uffici, contabilità, direzione generale

Gli investimenti di capitale nell’e-commerce

Gli investimenti di capitale vengono spesso considerati meno importanti rispetto ai costi operativi, ma nell’e-commerce non funziona così.

Spesso gli analisti si fermano al livello dei costi operativi per determinare la sostenibilità del conto economico del canale e-commerce. Questo vuol dire che gli investimenti in infrastruttura, ad esempio la realizzazione della piattaforma e-commerce, viene considerato al di sotto dell’EBITDA e quindi rientra solo nel calcolo dell’EBIT altrimenti noto come utile prima delle imposte e degli interessi sul capitale.

Nell’e-commerce, a differenza dei canali fisici bricks and mortar, gli investimenti in infrastruttura sono continui perché la tecnologia evolve continuamente.

| Canale digitale – E-commerce | Canale fisico – Bricks and mortar |

|---|---|

| Acquisto o affitto piattaforma e-commerce | Acquisto o affitto pareti negozio |

| Configurazione piattaforma e-commerce | Arredamento negozio |

| Implementazione funzionalità aggiuntive > Frequente | Implementazione funzionalità aggiuntive –> Raramente |

| Integrazione con nuovi canali digitali > Frequente | Integrazione con nuovi canali fisici –> No |

| Aggiornamenti alla piattaforma e-commerce > Cadenza regolare | Aggiornamenti strutturali > Raramente |

Corsi online per ecommerce finance

Fashion Ecommerce Management >>

Fashion Finance: Master Ecommerce Financial Planning & Cost Control >>